jetcityimage/iStock Editorial by means of Getty Visuals

Introduction

As a dividend advancement investor, I look for new expenditure alternatives in cash flow-building property. When I locate these property to be attractively valued, I usually add to my current positions. In addition, I just take edge of sector volatility as we see it currently by beginning new positions to diversify my holdings and increase my dividend money with less funds.

All through a economic downturn like the a single economist forecast, the purchaser discretionary sector may possibly underperform as buyers stick to their primary expenditures. It can be an option to examine businesses in this sector as the weakness may only be temporary, however the long-term potential customers keep on being intact. One of these companies is House Depot (NYSE:High definition), which traded for a higher valuation for a extended time.

I will analyze the firm applying my methodology for analyzing dividend advancement shares. I am employing the exact same system to make it a lot easier to review researched firms. I will look at the company’s fundamentals, valuation, progress opportunities, and threats. I will then consider to identify if it is really a great expense.

Trying to find Alpha’s organization overview displays that:

The House Depot operates as a dwelling enhancement retailer. It operates The Household Depot suppliers that promote different making components, household advancement goods, lawn and yard goods, décor products and solutions, and amenities servicing, repair service, and operations solutions. The corporation also features installation services for flooring, cupboards and cupboard makeovers, countertops, furnaces and central air units, and windows. In addition, it provides device and devices rental providers.

Fundamentals

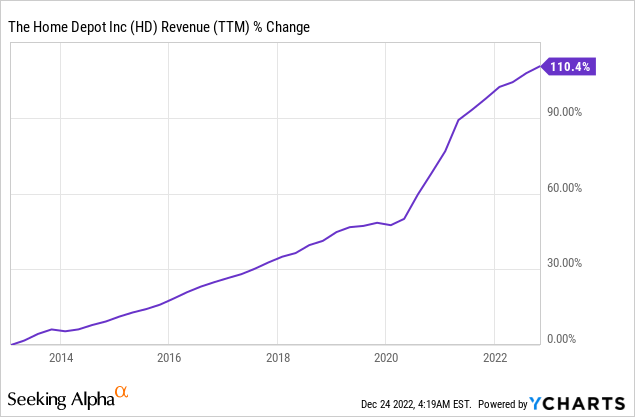

The revenues of Household Depot have been steadily increasing around the final 10 years. Product sales have more than doubled, which means they grew at an annual price of practically 8%. Income greater quickly for the duration of the pandemic as far more people today used extra time at property. So its overall look turned much more important for them. In the upcoming, as observed on Trying to find Alpha, the analyst consensus expects Property Depot to keep increasing revenue at an yearly charge of ~3% in the medium expression.

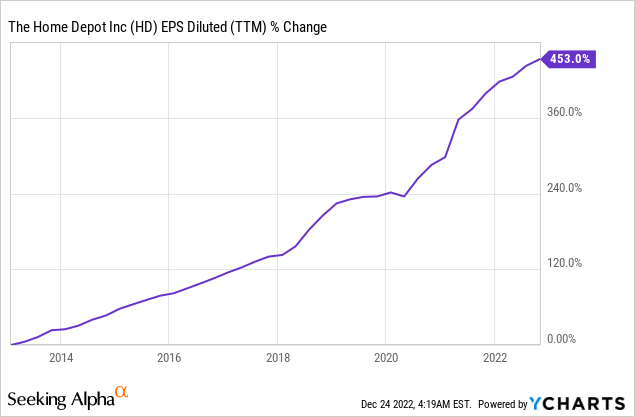

The EPS (earnings for each share) has been rising considerably speedier in the course of the exact same period. The EPS elevated by 450%, which signifies it is much more than 5 occasions larger than it was just a decade back. The firm obtained EPS development by rising gross sales, obtaining back its shares, and bettering margins by creating a superior digital experience and cutting charges. In the foreseeable future, as found on Seeking Alpha, the analyst consensus expects Home Depot to maintain growing EPS at an yearly rate of ~5% in the medium time period.

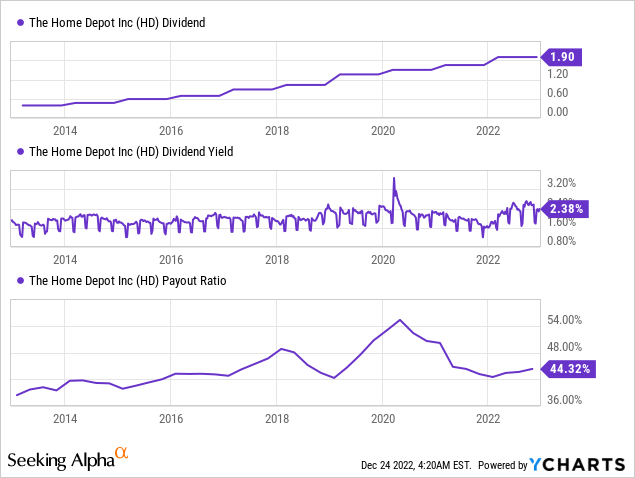

The company is a regular dividend payer. It hasn’t lessened the dividend for additional than thirty decades and improved it annually for 13 several years, which includes a 25% boost very last February. The dividend appears unlikely to be minimize as the corporation pays much less than 50% of its EPS. What’s more, the entry generate is bigger than its 10-calendar year typical. Although the common development charge about the past 5 yrs was 18%, traders ought to hope slower dividend development in the medium expression, as the EPS progress is slowing down.

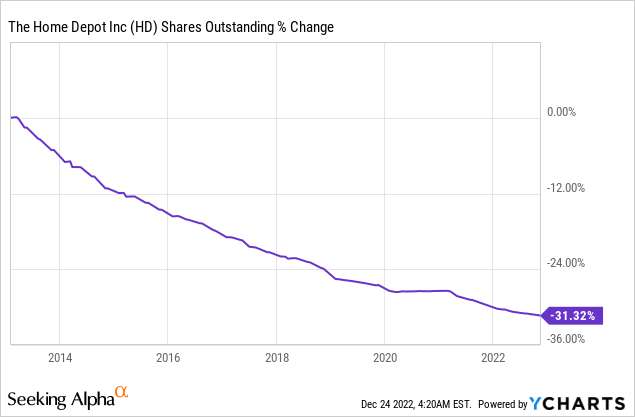

In addition to dividends, firms like Household Depot reward their shareholders by using share repurchase designs. Buybacks assist EPS development about time as they lower the number of excellent shares. Dwelling Depot purchased again virtually one particular-third of its shares in the earlier 10 many years. Buybacks are very efficient when shares are attractively valued, and if the volatility persists, it may well be an chance.

Valuation

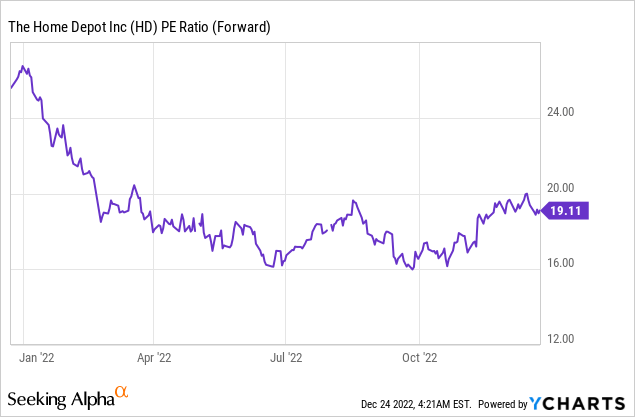

The P/E (price tag to earnings) ratio of the Property Dept is standing at 19.11 when taking into account the forecasted EPS of the existing 12 months. It is decreased at 18.8 when looking at the 2023 EPS forecast. Above the past twelve months, the valuation has decreased from a P/E ratio of 25 to a minimal of 16. The customer discretionary sector tends to be cyclical, so a tough company setting affects its valuation quickly.

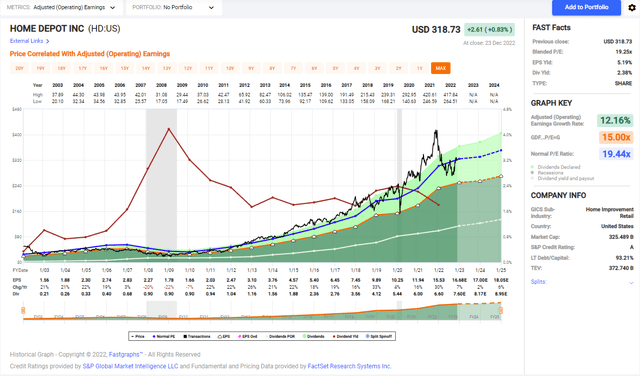

The graph underneath from Fastgraphs demonstrates that House Depot is lastly at its historical valuation once again, a scarce incidence in the final 5 years. The present P/E ratio is like the P/E ratio we have witnessed in the past 20 several years. On the other hand, traders really should also be informed that the forecasted growth price for the business, which stands at 5% per year, is slower than the 12% we observed in the previous two a long time.

Fastgraphs

Property Depot features buyers some good fundamentals with expansion in sales, EPS, dividends, and buybacks. The valuation of the inventory is in line with its historical valuation. Though it might be tempting to bounce into a inventory at a historic valuation, it is necessary to cautiously think about the firm’s growth prospective buyers and possible threats, as they might have a profound impact on its EPS development.

Opportunities

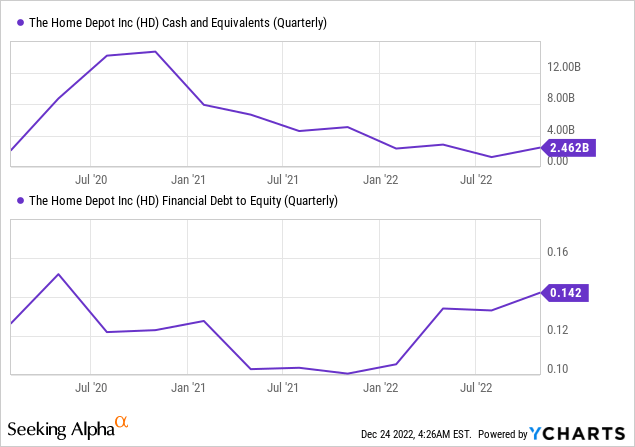

A single prospect in investing in Property Depot is the company’s stable financials and marketplace leadership. House Depot is the biggest home improvement retailer in the environment, with a existence in all 50 states and potent model recognition. In addition, Household Depot has a solid balance sheet with a lower debt-to-fairness ratio and a solid income situation of far more than $2B. These components propose that the company is nicely-positioned to weather conditions financial downturns, continue on growing in the prolonged expression, and it’s possible even obtain some rivals to improve its price proposition.

A further prospect in investing in House Depot is the rising need for property advancement solutions and solutions. The pattern of householders keeping in their households extended and investing in home renovations has been rising in the latest a long time, predominantly due to the fact of the pandemic. Even as the financial system is again to normal, we still see distant function, learning, and hybrid jobs. Additional time at dwelling will see a corresponding increase in desire for property advancement solutions and companies. It bodes nicely for Household Depot, as the business is properly-positioned to capitalize on this craze with its wide assortment of goods and solutions.

Another possibility in investing in Dwelling Depot is the firm’s diversification. It offers not only solutions but also the providers to build and set up them. It serves each close people and pros who resell it to their purchasers. Also, it is increasing into new nations these types of as Canada and Mexico. Providing extra products and services and goods in additional marketplaces with an increasing digital benefit proposition is crucial for long run expansion.

Hazards

A single hazard in investing in Home Depot is the possible effects of financial downturns and recessions. Residence advancement assignments are typically thought of discretionary paying out, indicating they may be between the 1st expenditures to cut through financial uncertainty. If the economy had been to enter a recession, this could guide to a decrease in demand from customers for home advancement merchandise and companies, which could negatively impression Home Depot’s economic efficiency.

One more possibility in investing in Home Depot is the levels of competition from other stores and on the web sellers. The property enhancement retail sector is remarkably competitive, with several prominent national and regional players vying for current market share, as Household Depot has a sizeable 18% share. In addition, e-commerce has manufactured it less difficult for customers to shop for house enhancement products on-line, most likely top to a decrease in retail store website traffic for Dwelling Depot. Home Depot is battling for market share and gives products and services desired to use the products.

In addition to the risks talked about earlier mentioned, a different threat in investing in Residence Depot is the likely effect of desire rates. Bigger fascination fees can make it additional highly-priced for individuals to finance house advancement jobs, probably major to a decline in need for the company’s products and solutions and solutions. It suggests that even if quite a few consumers had been not influenced by the economic downturn, they may well battle to finance highly-priced house renovation assignments. They may possibly both delay it or spend time. Equally are hard for Property Depot.

Conclusions

General, Dwelling Depot has powerful fundamentals, a reasonable valuation, and good options for advancement. Nevertheless, it is essential to notice that the business also faces numerous threats, specially in the small and medium term. Investors should anticipate steady dividend expansion, yet possibly at a slower speed in the coming many years as the corporation sails by means of a harsher enterprise environment.

Right after considering all of the above aspects, I believe that Household Depot is a Maintain at the present time. Traders really should contemplate bit by bit making a place in the company around time by purchasing on dips. It can aid to regular out the order cost and perhaps mitigate possibility. Ranking it as a Acquire would have meant that this is an attractive entry value. But, with slower development and volatile marketplaces, I believe investors really should invest in step by step. An appealing selling price will be a forward P/E of 14-15, as we have observed this calendar year.

:max_bytes(150000):strip_icc():focal(658x427:660x429)/home-improvement-then-now-022224-1-a2c6349af19b43358e4ab0a76c3a9cf5.jpg)