valentinrussanov/E+ via Getty Images

Lodging REIT stocks have been standing out in the real estate sector YTD, as business travel starts to pick up, adding to the leisure sector recovery. That comes against a economic backdrop where some high-profile executives are sounding the alarm due to higher interest rates, the war in the Ukraine, and supply chain disruptions in China.

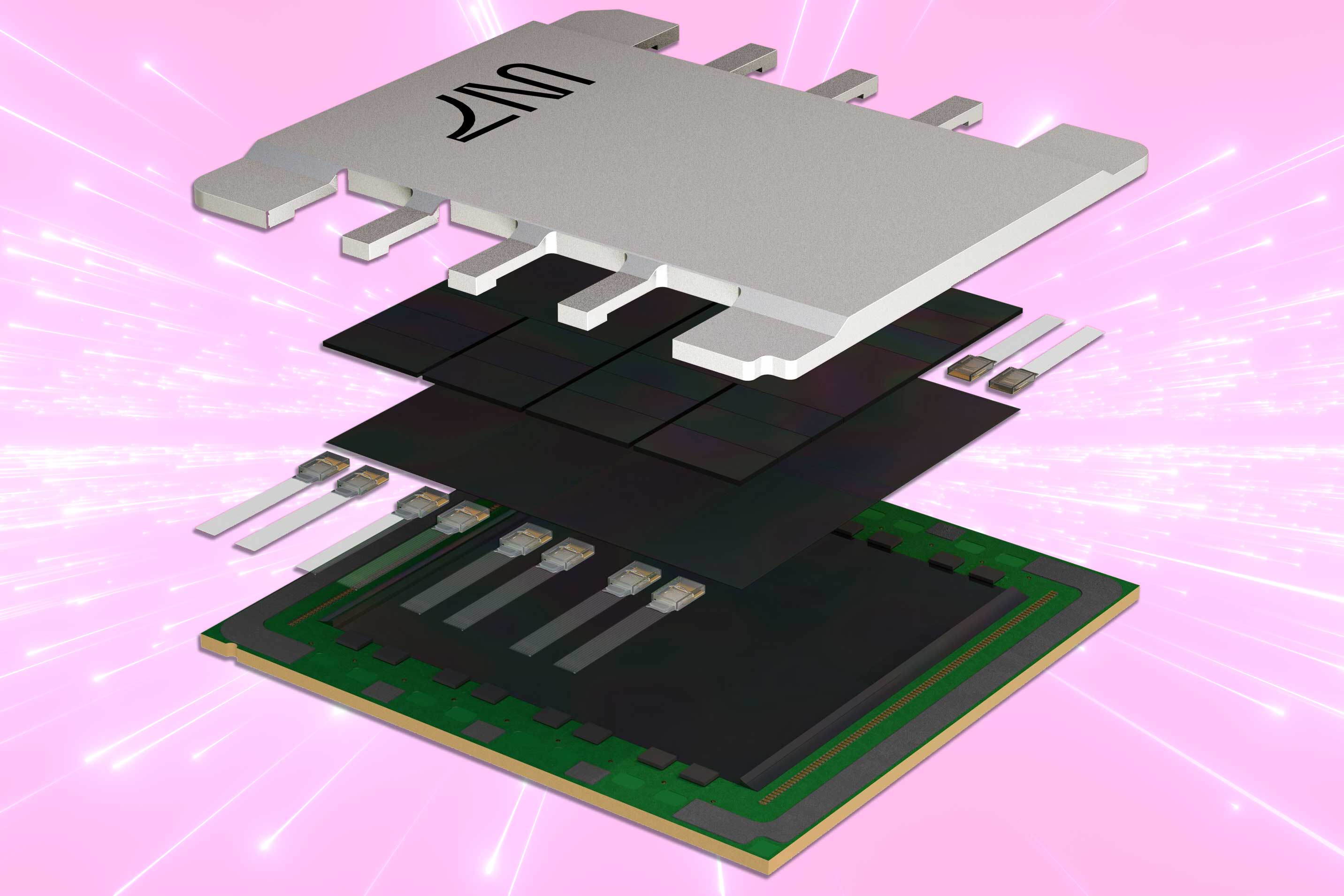

In the chart below, hotel/lodging REITs have risen 7.9% since the start of the year, as compared with the diversified REIT index, which fell 15%, and the S&P 500 -13% during the same timeframe. Residential (-17%) and Office REITs (-18%) fared the worst in this sample. Health Care REITS made progress, but still slipped 1%.

And three of the five best-performing REIT stocks were hotel REITs — DiamondRock Hospitality (NYSE:DRH) +7.5%, Pebblebrook Hotel Trust (NYSE:PEB) +7.0%, and Park Hotels & Resorts (NYSE:PK) +5.9%, said Evercore ISI analyst Steve Sakwa in a note dated June 3 (before market close).

Last month, Baird analyst Michael Bellisaro pointed to the improving trend for business travel, which will buoy both hotels and airlines. “Large technology, financial services firms have begun their return to office processes, which bodes well for the near-term business travel recovery,” he wrote in the firm’s Travel Report Card.

“The reopening momentum is palpable, and continued leisure demand strength coupled with quickly recovering midweek business travel gives us even more confidence that a more normalized travel environment will unfold over the next few months,” Bellisaro said.

On Tuesday, Truist Financial analyst C. Patrick Scholes upgraded Park Hotels (PK) to Buy from Hold and increased his 2022 EBITDA estimate to $585M from $525M and adjusted FFO per share estimate to $1.46 from $1.10. After evaluating Q1 lodging REIT earnings, he also raised full -year EBITDA estimates for DiamondRock (DRH), Host Hotels (NASDAQ:HST), Ryman Hospitality Properties (NYSE:RHP) and Sunstone Hotel Investors (NYSE:SHO).

On Thursday, Sunstone Hotel Investors (SHO) issued a business update that described the best demand growth at its urban and group-oriented hotels, which are “experiencing an increase in near-term booking activity, higher than expected attendance at group events, and increased business transient volume.”

Average daily rate at a 12-hotel comparable portfolio exceeded 2019 levels each month of 2022 and is higher by 11.3% in Q2 2022 QTD.

Baird’s Bellisario expects hotel REITs to give positive intra-quarter updates in their presentations at the Nareit meeting next week, “as May top-line performance was better than expected.”

“Investor sentiment broadly has shifted more negative recently given heightened concerns about slowing growth and consumer spending, but hotel fundamentals have continued their positive recovery trajectory,” he said. “Recent demand trends have been stronger than expected, which is being driven by the continued recovery of business and group travel and a still-strong leisure customer.”

For investment ideas in Hotels & Resort REITs, check out the SA stock screener.

Last month, SA contributor Daniel Jones said Park Hotels & Resorts (PK) is an attractive opportunity as the recovery proceeds nicely